Part Two

How to Get Started in Forex Trading

Steps to Open a Trading Account

To begin trading in the forex market, traders need to take several essential steps to open a trading account. Here are the steps to follow:

- Choose a Suitable Forex Broker

The first step is selecting a reliable and licensed broker for forex trading. It’s important to choose a broker that provides a secure and transparent trading environment, along with competitive spreads and excellent customer support services. - Register and Open an Account

After selecting the right broker, you’ll need to register to open an account. You will need to provide personal information such as your name, address, and email, along with submitting proof of identity according to regulatory requirements. - Choose the Type of Account

Most brokers offer multiple types of accounts (demo accounts and live accounts). A demo account is an excellent option for beginners to practice trading risk-free. Once you feel ready, you can open a live account. - Deposit Funds

After opening a live account, you will need to deposit the capital you intend to trade with. Most brokers offer several deposit methods such as bank transfers, credit cards, or e-wallets. - Download the Trading Platform

Most brokers provide online trading platforms or apps that can be downloaded on mobile devices. MetaTrader 5 is the most popular and widely used platform for forex trading. - Start Trading

Once your account is funded and the trading platform is downloaded, you can start placing buy and sell orders based on the analysis you’ve conducted.

Advantages of Opening an Account with DB Investing

DB Investing is one of the prominent brokers in forex trading and Contracts for Difference (CFDs). Here are some advantages that make it an ideal choice for traders:

- Regulation and Licensing

DB Investing is licensed by the Financial Services Authority (FSA) in Seychelles and the Securities and Commodities Authority (SCA) in the UAE, ensuring the company operates within a strict regulatory framework that protects traders’ rights and promotes operational integrity. - Wide Range of Tradable Assets

DB Investing offers a variety of financial instruments for trading, including:

– Forex currency pairs

– Precious metals like gold and silver

– Global indices

– Commodities like oil and natural gas

– CFDs on stocks and exchange-traded funds (ETFs)

– Cryptocurrencies like Bitcoin and Ethereum - Advanced Trading Platforms

The company provides the popular MetaTrader 5 platform, considered one of the best in the industry. This platform offers advanced tools for technical analysis, automated trading capabilities, and social trading features via ZuluTrade. - High Leverage

DB Investing offers leverage up to 1:1000, enabling traders to control larger positions with less capital. However, it’s important to be cautious, as leverage increases both risk and potential profit. - Multiple Account Types

DB Investing offers several account types to meet the needs of different traders:

– STP Account: No commission, spreads starting from 1 pip.

– ECN Account: Suitable for professional traders with spreads starting from 0.0 pips and a commission of $4 per lot.

– PRO Account: Designed for high-volume traders with spreads starting from 0.3 pips and a commission of $1.5 per lot.

– Islamic Account: Available without swap interest for traders who prefer this option. - Comprehensive Educational Support

DB Investing provides a wide range of educational resources, such as articles, courses, and webinars. Video content is also available to analyze the markets daily and offer valuable tips for traders, both beginners and professionals. - Excellent Customer Support

The company provides 24/5 customer support through various channels such as email, live chat, and phone. This service ensures traders get the help they need quickly and at any time. - Easy Deposit and Withdrawal

DB Investing offers multiple payment options, including local and international bank transfers, credit cards, e-wallets like Skrill and Neteller, and cryptocurrencies like USDT. Withdrawals are processed quickly and without fees.

How to Buy and Sell Currency Pairs

How to Execute Trades

Forex trading involves buying one currency while selling another simultaneously. This is done through currency pairs, where the pair shows the value of one currency against another. When you expect the first currency’s value to rise compared to the second, you buy the pair (Going Long). If you expect the first currency’s value to fall, you sell the pair (Going Short).

Here are the basic steps to execute trades:

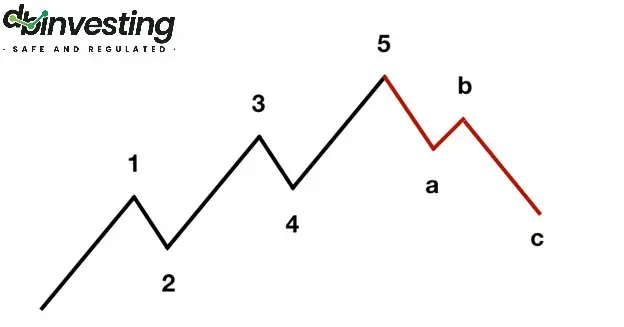

- Market Analysis

Before buying or selling, you should analyze the market using technical or fundamental analysis tools. Technical analysis relies on studying charts and patterns, while fundamental analysis focuses on economic news and financial policies. - Open a Trade Position

After deciding whether to buy or sell based on your market analysis, you can open a trade position through your trading platform, such as MetaTrader 5

– If you expect the first currency to rise against the second, you buy the pair (e.g., buy EUR/USD if you expect the Euro to rise against the US dollar).

– If you expect the first currency to fall against the second, you sell the pair (e.g., sell GBP/USD if you expect the British Pound to fall against the US dollar). - Determine the Trade Size

When opening a position, you must decide on the trade size, usually measured in lots. A standard lot is equal to 100,000 units of the base currency, but you can trade smaller sizes like a mini lot (10,000 units) or a micro lot (1,000 units). - Set Stop Loss and Take Profit Orders

To protect your capital, you should set a stop loss order to define the maximum loss you’re willing to tolerate. Additionally, you can set a take profit order to close the trade when the desired profit is achieved. - Monitor the Market and Manage the Position

After opening the trade, you will need to monitor the market and manage your positions based on price movements. You can adjust stop loss and take profit orders or even manually close the trade if the market direction changes. - Close the Trade

When you reach your profit target or wish to limit losses, you can close the trade. When closing the trade, you either sell the currency you bought or buy back the currency you sold, depending on the type of trade.

Tips for Successful Trades

- Use Leverage Cautiously: In forex trading, leverage allows you to increase your positions using less capital. However, you should be cautious when using leverage as it amplifies both profits and losses.

- Constantly Analyze the Market: Whether you follow a fundamental or technical analysis strategy, it’s essential to stay updated on market movements and economic news that may affect currency prices.

- Stick to a Trading Plan: It’s always recommended to follow a specific trading plan that includes rules for risk management and goal achievement. This reduces the risks from emotional or undisciplined trading.

Summary

The process of buying and selling currency pairs depends on making informed decisions based on technical and fundamental analysis. Setting clear goals and effectively managing risks helps in achieving successful trades and generating profits while minimizing potential losses.

In this second part, we covered how to start forex trading, from the steps to open an account, the features you should look for in a broker, to a detailed explanation of how to buy and sell currency pairs.

In the third part, we will discuss in more detail the potential risks you may face while trading, as well as the best times to enter the market and seize available opportunities. Stay tuned to continue this comprehensive guide to forex trading.