Introduction

At DB Investing, empowering traders with effective tools and strategies is at the core of what we do. Among these tools, Fibonacci levels stand out as a widely used method to identify potential support and resistance areas in the financial markets. Named after the Italian mathematician Leonardo Fibonacci, these levels are horizontal lines derived from Fibonacci percentages—23.6%, 38.2%, 61.8%, and 78.6%. The commonly used 50% ratio, though not a Fibonacci number, is also considered an essential reference for traders.

Importance of Fibonacci Levels

Fibonacci levels offer a method to analyze market movements by connecting two significant price points, such as the highest and lowest prices, and drawing retracement levels between them. At DB Investing, we believe traders can enhance their strategies by mastering these levels to forecast potential market reversals and continuations.

The General Formula for Fibonacci Levels and How to Calculate Them

Fibonacci retracement levels are calculated using the Fibonacci sequence, which follows a specific formula. The sequence starts with 0 and 1, and each subsequent number is the sum of the two preceding ones:

- F(0) = 0

- F(1) = 1

- F(n) = F(n-1) + F(n-2) for n > 1

Where:

- F(n) is the number that appears at the nth position in the Fibonacci sequence.

- F(0) equals 0.

- F(1) equals 1.

- F(n) is calculated by adding the previous two numbers to obtain the next number in the sequence (F(n-1) + F(n-2)).

Fibonacci Sequence Overview:

- F(0) = 0

- F(1) = 1

- F(2) = F(1) + F(0) = 1 + 0 = 1

- F(3) = F(2) + F(1) = 1 + 1 = 2

- F(4) = F(3) + F(2) = 2 + 1 = 3

- F(5) = F(4) + F(3) = 3 + 2 = 5

Thus, each number is the sum of the two preceding numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, and so on. This series continues infinitely, and any number in the sequence can be calculated by adding the two previous numbers.

Insights from Fibonacci Levels

At first glance, everything in this sequence appears natural. However, there is a fascinating relationship discovered in the connection between consecutive numbers. This relationship is observed not only in the Fibonacci sequence but also in various aspects of human life, nature, and even the smallest parts of the human body, such as chromosomes.

The Fascinating Relationship in the Sequence

It is worth noting that the results of the mathematical process in the relationship between numbers in any arithmetic sequence will always yield the same result, no matter how the sequence is formulated. This relationship has been found in numerous other phenomena related to human life, aesthetics, and even in the smallest parts of the human body, like chromosomes, which humans rely on for their natural functions. This relationship has also been observed in the largest galaxies in the universe and throughout nature.

The mathematical operation involves dividing a number by the one that precedes or follows it, as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610…

- Dividing any number by the next one results in approximately 0.618.

- 610 / 377 = 1.618

- 233 / 144 = 1.618

- 89 / 55 = 1.618

- Dividing the previous number by the current one results in approximately 1.618.

- 377 / 610 = 61.8

- 144 / 233 = 61.8

- 55 / 89 = 61.8

Excess Fibonacci Levels

What if we reverse the mathematical operation so that the previous number is divided by the next one: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610…

- 377 / 610 = 61.8

- 233 / 144 = 61.8

- 144 / 233 = 61.8

By reversing the operation, we still get a constant value of 61.8.

What if we divide a number by a number two positions before it in the sequence?

- 610 / 233 = 2.618

- 144 / 55 = 2.618

- 89 / 34 = 2.618

We see the number has changed from 1.618 to 2.618, where the difference between 1 and 2 represents the difference in the numbers being divided. If we reverse the division, the result is 38.2.

If we divide a number by one with a two-step difference, the result is 4.236:

- 610 / 144 = 4.236

- 233 / 55 = 4.236

Reversing the division gives 0.236:

- 144 / 610 = 0.236

- 55 / 233 = 0.236

Conclusions

From the above, we can conclude that dividing any arithmetic sequence by itself yields constant results that never change, and these results are considered laws and constants.

The Relationship in the Market

These constants can be seen everywhere, as mentioned earlier. But the question is: what do they represent in the market, and how can they be useful?

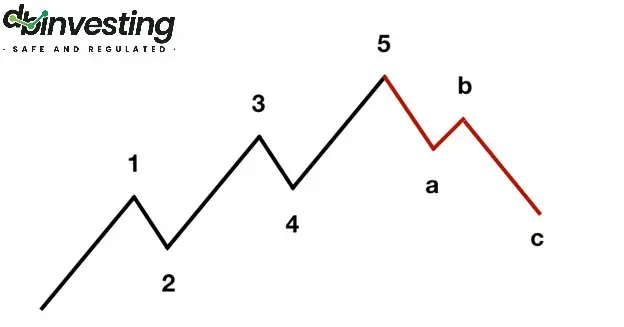

It is known that market patterns and events depend on two factors: time and price movement, which form patterns. These movements are always constant and not random, and their outputs are predictable. Therefore, Fibonacci numbers are used for their stability in mathematical outputs, as explained earlier. But what does each number mean?

Before explaining further, we must reference the relationship in the mathematical operations for the results of the numbers: 423.6, 261.8, 161.8, 61.8, 38.2, 23.6

If we divide these numbers by each other, we get the same results as in the previous operations:

- 23.6 / 38.2 = 0.618

- 38.2 / 23.6 = 1.618

- 423.6 / 261.8 = 1.618

- 38.2 / 23.6 = 1.618

We observe that the results of the mathematical operations in the sequence are also equal to the initial outputs. This consistency is based on the previous mathematical principle and demonstrates the stability in the results of arithmetic sequences, or what is referred to as the golden ratio 61.8 and 161.8.

The Golden Ratio

What do the golden ratios 61.8 and 161.8 represent? As demonstrated, 61.8 is the result of two consecutive numbers in the arithmetic sequence, and 161.8 is the reverse of the same process. These are identical outcomes from dividing the results of these operations. If we consider a specific price movement between 0% and 100%, the constant ratios in the sequence are 23.6%, 38.2%, and 61.8%, all within the complete movement from 0% to 100%. However, the numbers 161.8%, 261.8%, and 423.6% are outside the full range represented by 0% to 100%, and are therefore called price extension numbers.

Thus, the numbers 161.8, 261.8, and 423.6 represent extension levels, where the price is expected to reach if it breaks out of a certain price movement range beyond the 0% to 100% range.

Setting and Installing Fibonacci Levels

There are various types of Fibonacci levels that can be used, such as Fibonacci Channels, Fans, and others, but it is recommended to use Fibonacci Retracement levels. These levels are drawn by connecting the highest and lowest points (the highest and lowest price points) within a certain period, and they represent key support and resistance areas.

Installing the Tool on MetaTrader 4

You can install and draw this tool on MetaTrader 4 or 5 using one of two methods:

- Find the “Draw Fibonacci Retracement” option in the top toolbar of the platform.

- From the Insert menu in the top bar of the platform, you will find the Fibonacci option, then select Retracement.

Advantages and Disadvantages of Using Fibonacci Levels in Trading

Advantages

- Helps identify potential support and resistance areas in the market.

- Provides important time ratios for price movement projections and potential extension and retracement periods.

- Increases traders’ confidence when a potential price reversal aligns with key Fibonacci levels.

- Both beginners and professional traders can benefit from Fibonacci levels.

Disadvantages

- Some traders may initially find it difficult to correctly understand and apply Fibonacci levels.

- Relies on historical price analysis and may not always be accurate, especially during rapid market changes.

- Requires additional indicators to confirm the validity of signals.

Conclusion

At DB Investing, we view Fibonacci levels as a powerful tool for traders aiming to refine their strategies. Success with Fibonacci levels hinges on combining technical knowledge with comprehensive market analysis. By leveraging these insights, traders can navigate financial markets with increased confidence and precision. The effectiveness of using Fibonacci levels depends on the trader’s skills and experience and their ability to analyse the market comprehensively. Fibonacci levels should be viewed as an additional tool in the decision-making process, not as a substitute for relying on thorough research and market analysis